Digital Transformation in Banking: Citi Global Union’s Technological Evolution

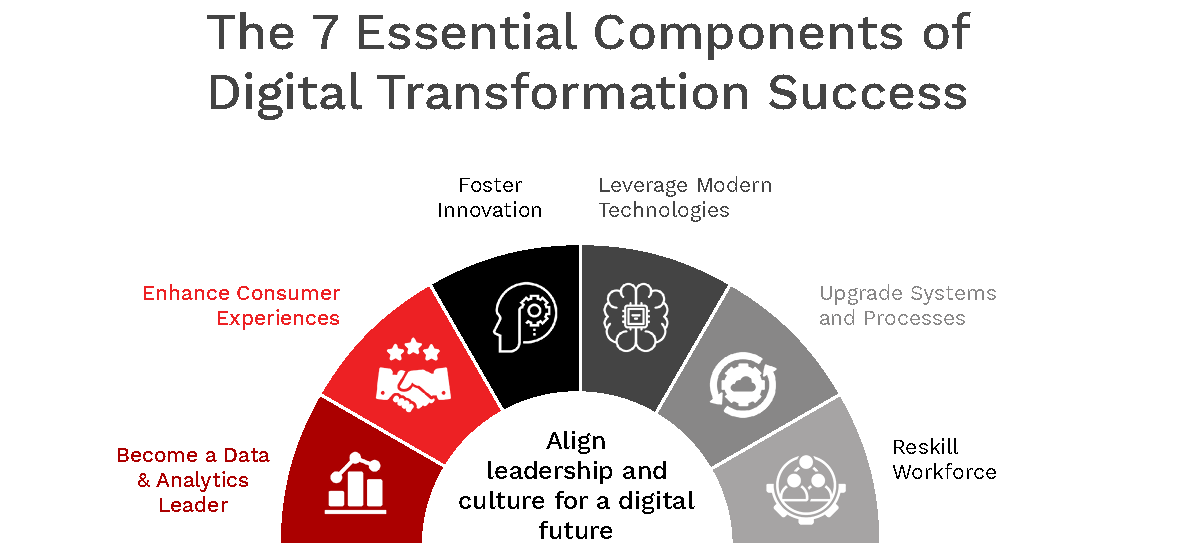

The landscape of banking is undergoing a profound transformation, driven by rapid advancements in technology. At Citi Global Union, we are at the forefront of this digital evolution, leveraging cutting-edge innovations to enhance the banking experience for our clients. In this exploration, we delve into the intricate details of Citi Global Union’s technological evolution and how our commitment to digital transformation is reshaping the future of banking.

Embracing Technology for Enhanced Customer Experience:

Digital transformation is not just a buzzword at Citi Global Union; it’s a commitment to providing our clients with a seamless and user-friendly banking experience. From the convenience of online banking to the accessibility of mobile apps, our technological evolution is centered around making banking transactions efficient, secure, and tailored to the needs of the modern consumer.

Online Banking Features:

Citi Global Union’s online banking platform is a testament to our dedication to customer-centric solutions. Clients can manage their accounts, transfer funds, pay bills, and monitor transactions with just a few clicks. The intuitive design ensures a user-friendly experience, allowing clients to navigate effortlessly through their financial activities.

Fintech Integration:

The integration of financial technology (fintech) is a cornerstone of Citi Global Union’s technological evolution. We continually embrace the latest fintech trends to bring innovative solutions to our clients. Whether it’s contactless payments, robo-advisors for investment guidance, or blockchain technology for secure transactions, our bank stays ahead of the curve, ensuring our clients benefit from the latest advancements in the financial industry.

Enhanced Security Measures:

As technology advances, so do potential security threats. Citi Global Union prioritizes the safety of our clients’ financial information. Our technological evolution includes state-of-the-art security measures, such as multi-factor authentication, encryption protocols, and real-time fraud monitoring. We are committed to providing a secure digital environment, giving our clients the confidence to engage in online banking without compromising their privacy.

Mobile Banking for On-the-Go Accessibility:

In a world where mobility is key, Citi Global Union’s mobile banking app empowers clients with the freedom to manage their finances on the go. The app offers features such as mobile deposits, account alerts, and easy access to account statements. Our commitment to mobile banking reflects our understanding of the importance of flexibility in the modern lifestyle.

Personalized Financial Insights:

Understanding our clients’ financial habits is crucial to offering personalized services. Citi Global Union’s technological evolution includes the use of data analytics to provide clients with personalized financial insights. From spending patterns to investment opportunities, our clients receive tailored recommendations that align with their financial goals.

Innovative Customer Engagement:

Digital transformation goes beyond transactional convenience; it extends to fostering meaningful relationships with our clients. Citi Global Union utilizes innovative customer engagement strategies, such as AI-powered chatbots for instant customer support and virtual financial advisors for personalized consultations. Our goal is to create a banking experience that is not only efficient but also responsive to the individual needs of our clients.

Evolving with Emerging Technologies:

The technological landscape is ever-evolving, and Citi Global Union remains proactive in adopting emerging technologies. From artificial intelligence and machine learning to biometric authentication, our bank explores opportunities to enhance the banking experience. Our commitment to staying at the forefront of technological advancements ensures that our clients have access to state-of-the-art solutions that redefine the possibilities of modern banking.

User Education and Empowerment:

As part of our technological evolution, Citi Global Union places a strong emphasis on user education. We provide resources, tutorials, and interactive sessions to empower our clients with the knowledge needed to leverage our digital services effectively. By fostering digital literacy, we aim to bridge the gap between technological advancements and user confidence.

Environmental Sustainability:

Citi Global Union’s technological evolution is not only about improving services but also about contributing to environmental sustainability. We embrace eco-friendly practices, such as paperless statements and digital documentation, reducing our carbon footprint and promoting a greener banking experience.

Conclusion:

In conclusion, Citi Global Union’s commitment to digital transformation is a testament to our dedication to providing the best possible banking experience for our clients. Our technological evolution is not just about embracing the latest trends; it’s about anticipating the future needs of our clients and staying ahead in a dynamic digital landscape. As we continue to evolve, we invite our clients to join us on this exciting journey where technology meets innovation, creating a banking experience that is not only efficient but also enriching. Explore the possibilities with Citi Global Union and be a part of the future of banking.